The U.S. housing and mortgage market experienced significant changes due to fluctuating mortgage rates, home sales, and inventory levels. This analysis covers mortgage rates, home sales, housing inventory, prices, and the economic outlook for the housing market.

Mortgage Rates and Home Sales

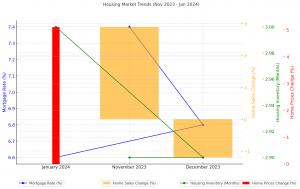

In late 2023, mortgage rates fell from an average of 7.4% in November to 6.8% in December and 6.6% in January 2024. This decline helped the housing market recover from the lows of 2023. In January 2024, total home sales (existing and new) rose by 2.9% from December 2023, but they were still down 1.2% compared to January 2023. Existing home sales saw a significant increase of 3.1% from December 2023, reaching 4.0 million in January. This was the largest monthly gain in a year. However, existing home sales were still 1.7% lower than in January 2023.

Housing Inventory and Prices

The existing housing inventory in January 2024 increased slightly by 2% from December 2023, representing a 3.0 month’s supply at the current sales pace. Despite this increase, the median home price rose by 5.1% year-over-year, worsening the ongoing affordability issues in the housing market. Affordability is now at a nearly 30-year low, deterring many potential homebuyers from entering the market.

New Home Sales and Builder Incentives

In January 2024, new home sales were 1.5% higher than in December 2023. To address affordability challenges, many builders have been offering sales incentives. This move aims to attract more buyers despite rising prices and tight inventory.

Home Prices and Mortgage Rates

Home prices continue to show strength. The FHFA Purchase-Only Home Price Index for December 2023 increased by 0.1% month-over-month, following a 0.4% rise in November 2023. Year-over-year, home prices were up by 6.6%. Despite the deceleration in December, home prices are still rising faster than overall consumer prices.

Outlook for Economic Growth and Inflation

The U.S. economic outlook remains broadly positive, with expectations of modest economic growth. However, this growth will be slower than the previous year. This trend will likely result in moderate payroll employment growth and a slight increase in the unemployment rate. Inflation is expected to moderate eventually, but a growing economy will keep it above the 2% target in the short term. Therefore, the Federal Reserve is not expected to cut rates until summer. Potential inflation surprises could delay rate cuts even further. As a result, treasury yields will remain elevated in the near term, keeping mortgage rates high. Mortgage rates are forecasted to stay above 6.5% this quarter and the next.

economic outlook remains broadly positive, with expectations of modest economic growth. However, this growth will be slower than the previous year

Housing Market Challenges and Recovery

The housing market faces challenges due to high mortgage rates and limited inventory. However, we expect a modest recovery in home sales as mortgage rates decrease in the latter half of the year. This scenario assumes that inflation moves closer to the target, prompting the Federal Reserve to cut the federal funds rate. The rate lock effect will limit the recovery, preventing many homes from coming on the market. Home prices are expected to remain under upward pressure as more first-time homebuyers enter a market plagued by a supply shortage. Home prices will increase by 2.5% in 2024 and 2.1% in 2025.

Key Takeaways

-

Mortgage Rate: declined significantly from 7.4% in November 2023 to 6.6% in January 2024.

-

Home Sales: Total home sales were up 2.9% from December 2023 but down 1.2% from January 2023.

-

Housing Inventory: Slight increase in January 2024, representing a 3.0 months’ supply.

-

Home Prices: Median price up 5.1% year-over-year, worsening affordability issues.

-

Builder Incentives: New home sales are up 1.5% from December 2023 with increased sales incentives.

-

Economic Outlook: Positive with modest growth; inflation above 2% in the short term; mortgage rates to stay above 6.5%.

-

Market Recovery: Expected modest recovery in home sales in the latter half of the year with continued pressure on home prices.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link